Published by Daniel Morrison, Founding Partner and Wealth Advisor

The marathon journey to retirement is nearly over, and the finish line is finally in sight! You’ve been working your whole life to reach this milestone, and you’re ready to put those years of calculating, strategizing, and saving behind you. But if you’re feeling tempted to hang up your financial planning hat…not so fast. In order to take full advantage of your golden years, it’s important to continue to make sound financial decisions and take action when it comes to your financial strategy.

Retirement brings its own set of challenges to the table, and we’ve found that most retirees face the same 5 financial planning challenges within the first 10 years. Let’s discuss these challenges so you can be prepared and confident to tackle them.

1. Not Creating a Withdrawal Strategy

How do you turn your hard-earned savings into an income stream to replace the income you will lose from not having a steady paycheck? It’s not an easy question, but how you take your money out is just as important as how you put it in. It includes tax planning, reviewing your tax return, and, most importantly, distribution optimization. That’s why you should capitalize on your wealth by determining a tax-efficient way to withdraw funds in your golden years.

Different financial accounts are taxed at different rates. Traditional IRAs and 401(k)s get taxed at the ordinary income tax rate when you withdraw. Roth IRAs and Roth 401(k)s are taxed beforehand, so the money is withdrawn tax-free. Funds in a taxable investment account are taxed at the capital gains tax rate, which is different from your ordinary income tax rate.

Calculating when might be the best time to pull from each account is enough to give anyone a headache. But the last thing you want is to get hit with a hefty tax bill when you’re trying to stretch your money for decades. Create a withdrawal strategy with the help of a trusted professional who can assist you in withdrawing funds at a sustainable rate and help ensure that you’re doing it in a tax-efficient way.

2. Throwing the Budget Away

Many people spend their retirement years doing all the things they never got to do when they were working: starting a passion project, remodeling the house, traveling the world, and more.

It’s easy to underestimate the amount of money you’ll spend during those first few years when you don’t account for all these “extras.” Overspending, even for a short period, can shave years off the longevity of your assets. The solution? Create a spending plan. Calculate your monthly income given your withdrawal strategy, and then create a budget, tracking your money along the way so you stick to your goals.

3. Ignoring Inflation

Another major challenge we see new retirees face is the desire to play it safe in the stock market. This can do more harm than good as it can lead to inflation risk.

The long-term average inflation rate for healthcare expenditures is 5.23%,[1] and the current average inflation rate is a whopping 5.3%.[2] This means retirees are more likely to feel the effects of inflation due to necessary expenses, such as healthcare costs.

As tempting as it may be, resisting the urge to worry about short-term stock market volatility may be a good option. With a retirement that could easily last 20 to 30 years, inflation is still a significant threat to your nest egg. Sit down with a trusted professional who can help you strike a balance between principal protection and growth.

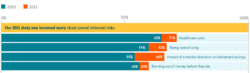

A 2021 Retirement Risk Readiness Study from Allianz insurance company found that 71% of participants were worried about the rising costs of healthcare, 67% were worried about rising costs of living, and 66% were worried that market downturns would affect their savings.[3] These percentages represent significant increases from the survey’s 2020 results.[4]

With a retirement that could easily last 20 to 30 years, inflation is a significant threat to your nest egg. Sit down with a trusted professional who can help you strike a balance between principal protection and growth and be proactive about inflation risk.

4. Neglecting to Create an Emergency Fund

Could you comfortably pay for an unexpected, major expense in retirement without jeopardizing your financial future? For most of us, the answer is no. Just as you were taught to have an emergency fund in your formative years, it’s even more critical to have one in your retirement years.

Most professionals recommend that retirees have at least 12 to 18 months of expenses in an easily accessible savings account.[5] This may sound like a lot, but an emergency fund serves two purposes: it covers unexpected expenses and it can provide stability during economic downturns. This means you can optimize your portfolio to help beat inflation, as suggested above, while having a safety net to fall back on.

There are other factors that should be considered in determining how much of an emergency fund to maintain, including pensions, other guaranteed income streams, and your required minimum distributions (RMDs). Working with a professional can help you determine how much of an emergency fund to maintain given your specific situation.

5. Planning on Your Own

When facing any challenge, you know that the best outcome results when you seek out the professional most qualified. You turn to a doctor for health concerns. You turn to a mechanic for car trouble. So although you might have DIY’d your personal finances up until now, retirement is not the time to wing it. Having a trusted wealth manager by your side can be the difference between having a retirement fund that dries up or one you can’t outlive.

Our team at Jacob William Advisory would love to be the qualified professionals you turn to for help tackling these challenges (and others) on the road to a comfortable retirement—in fact, our focus is to secure, maintain, and protect your financial lifestyle throughout every stage of life. If you would like to find out more about how we can help, contact our office by calling 410-821-6724 or emailing [email protected] or schedule an appointment at https://www.jacobwilliam.com/insights/#contact.

About Dan

Daniel Morrison is a Founding Partner and Wealth Advisor of Jacob William Advisory, a wealth management firm whose sole mission is to service their clients’ needs beyond their expectations. Dan Morrison has 27 years of industry experience, and for the past decade, he has been committed to building Jacob William Advisory into one of the foremost wealth advisory firms. Dan graduated from Towson University with a bachelor’s degree of finance in economics and obtained his master’s degree in finance from the University of Baltimore. He is a CERTIFIED FINANCIAL PLANNER™ professional and holds the designations of Chartered Financial Consultant® (ChFC), Chartered Life Underwriter (CLU), and Chartered Advisor for Senior Living (CASL). He and his wife Beth reside outside of Baltimore, Maryland, and have three wonderful children. Dan is involved in his church and he enjoys spending time with his family, playing golf, and sailing. A good book is also never far from his reach. Learn more about Dan by connecting with him on LinkedIn.

This piece is not intended to provide specific legal, tax, or other professional advice. For a comprehensive review of your personal situation, always consult with a tax or legal advisor.

[1] https://ycharts.com/indicators/us_health_care_inflation_rate

[2] https://www.usinflationcalculator.com/inflation/current-inflation-rates/

[3] https://www.allianzlife.com/-/media/files/global/documents/2021/07/08/19/42/ent-3625.pdf

[4] https://www.allianzlife.com/-/media/files/allianz/pdfs/newsroom/ent-3474.pdf

[5] https://www.thebalance.com/how-much-emergency-savings-do-retirees-need-4582473